Understanding Financial Year, Assessment Year 2022–23 (AY 2023–24), and Important ITR Deadlines

What do Financial Year and Assessment Year mean?

The Financial Year is the designated period in which income is generated and expenses are accrued. In the given context, the return being submitted pertains to the income earned in FY 2022–23, which encompasses the duration from April 1, 2022, to March 31, 2023. Conversely, the Assessment Year (AY) signifies the year when the income tax return is examined and evaluated. For the income earned in the specific FY (2022–23), the assessment year would follow, commencing on April 1, 2023, and concluding on March 31, 2024. Hence, the assessment year corresponding to FY 2022–23 would be AY 2023–24.

The Commencement date for Income Tax Return (ITR) filing in 2023:

It is anticipated that the beginning of Income Tax Return filing for Assessment Year 2023–24 (Financial Year 2022–23) will take place soon. It is anticipated by experts that the ITR filing procedure would begin in the first week of June. The offline utility is now made available by the Income Tax Department for the submission of ITR-1, ITR-2, and ITR-4 forms.

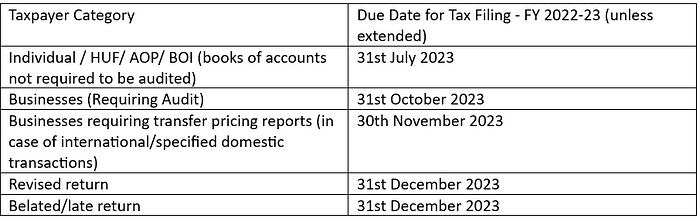

Now, let’s see the deadline for filing ITR for FY 2022–23.

Due dates for income tax filing in FY 2022–23 (AY 2023–24):

What are the consequences of missing the ITR filing deadline?

If you fail to file your return by the due date, the following consequences apply:

· Interest: Regarding interest, you will be responsible for paying interest according to Section 234A. The interest rate is set at 1% per month or any portion thereof, based on the outstanding tax amount.

· Late fee: In terms of the late fee, under Section 234F, a late fee of Rs. 5,000 will be required. Nevertheless, if your total income is below Rs. 5 lakh, the late fee will be lowered to Rs. 1,000.

· Loss Adjustment: If you have incurred losses from investments in stocks, mutual funds, properties, or any of your businesses, you can carry them forward and adjust them against your income in the subsequent years. This helps in significantly reducing your tax liability. However, loss adjustment is only permitted if you declare the losses in your ITR and file it with the income tax department before the deadline.

· Belated Return: In case you miss the ITR filing due date, you can still file a return after the due date, known as a belated return. However, you will have to pay the late fee and interest as mentioned earlier. Moreover, you will not be allowed to carry forward the losses for future adjustments. The income tax department has specified that the due date for filing a belated return is 31st December of the assessment year (unless extended by the government). Therefore, for the current year, you can file the belated return no later than 31st December 2023.

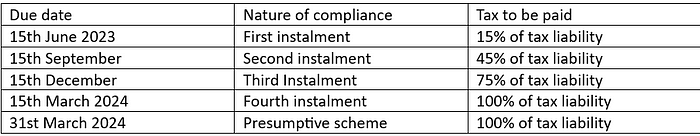

Important due dates for paying advance tax instalments in FY 2023–24:

In addition to filing income tax returns in Delhi, there are other tax-related obligations to fulfil within specific deadlines, such as paying advance tax. The due dates for advance tax payments in FY 2023–24 are as follows: